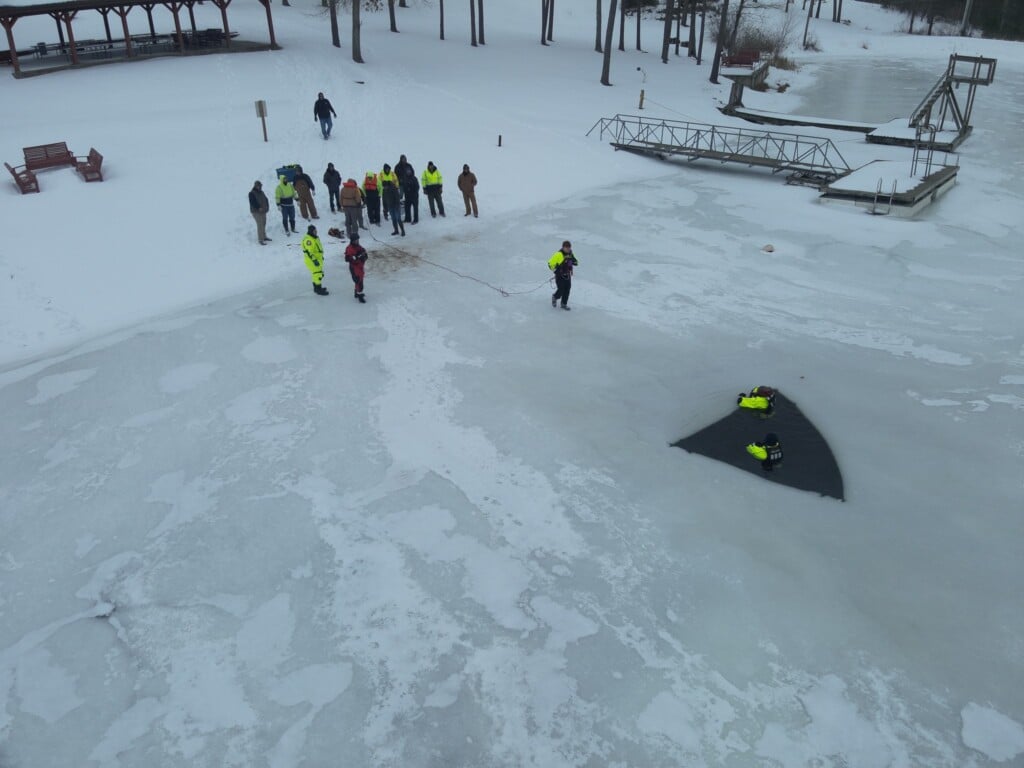

Retired first responders are eligible for a tax reduction in Illinois

ILLINOIS (KBSI) – A tax deduction aimed at relieving tax stress on first responders in available to Illinois residents.

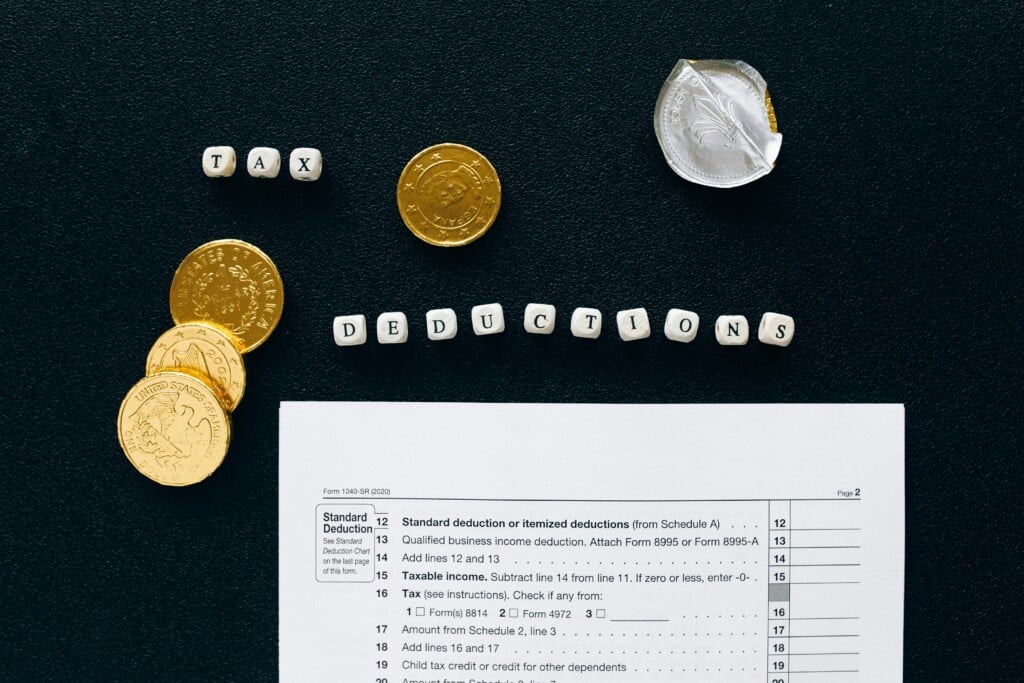

According to the Illinois Pension Fund Association n existing federal tax deduction for health care expenses can and should be used by more first responders nationwide, including in Illinois, and may help to reduce taxable earnings by up to $3,000.

The Illinois Public Pension Fund Association (IPPFA) encourages retired public safety officers to take advantage of the tax reduction.

Through Healthcare Enhancement for Local Public Safety Retirees Act, or the “HELPS” Retiree Act the tax reduction act allows retired law enforcement officers, firefighters and emergency services personnel across the United States to lower their taxable pension income by excluding premiums for health insurance.

Retirees may reduce their taxable earnings by up to $3,000 for medical insurance premiums paid during a calendar year.

“Any premium paid for health, accident or long-term care insurance qualifies for the credit,” said .IPPFA President James McNamee. “There was previously a requirement that the premium had to be deducted from the retiree’s pension check in order to qualify for HELPS credit, but that is no longer the case. Now more than ever, our retired heroes should make sure they take advantage of the HELPS credit.”

The $3,000 deduction does not appear on the annual 1099R form that is sent out by the pension or retirement fund.

The retiree must claim the deduction on his or her personal 1040 tax form on line 5B. Instructions on claiming the deduction are included in IRS Publication 575, page six, General Information / Insurance Premiums for Retired Public Safety Officers, and also on page two.

For more information on the HELPS tax you can follow the link.